Corporate reporting is important for any business that wants transparent financial performance and operational efficiency. Management teams, investors, auditors, regulators, and financial institutions always focus on accurate reporting to make informed decisions. At the foundation of this reporting process lie business bank statements.

Business bank statements serve as an official record of any business’s financial activity. They capture cash inflows, outflows, balances, and transaction details that directly support financial statements and internal reports.

In this blog post, you will get to know about the role of business bank statements in corporate reporting and why they are essential for effective financial management.

What are Business Bank Statements?

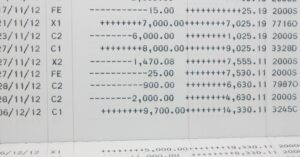

Business banking statements are documents issued by the banking institution that record the activities undertaken on the account within the specified time. These include the following details:

- Deposits

- Withdrawal transactions

- Transfer transactions,

- Fees, interest earned

- Closing balance

Bank statements are distinct documents that are separate from the records maintained in the accounts department. They are considered verification documents confirming the transactions undertaken by commercial organizations.

Why Business Bank Statements Are Critical to Corporate Reporting

Bank statements play an important role in financial reporting, as they provide a clear picture of how money is flowing in and out of your account and for what purposes. It plays the following role in financial corporate reporting:

-

Verification of Financial Records

Business bank statements have confirmed that the accounting entries made in the company are consistent with what actually happened at the bank. That’s why, to make it helpful, you have to write the actual transaction amount that took place.

-

Protective Services

The bank statement needs to be precise, and a business bank statement generator helps companies make sure that they comply with the rules and regulations concerning the financial reporting of the business.

-

Audit Readiness

The business bank statement helps the auditor obtain primary evidence to verify the cash balances and the recording of other transactions with the accounting entity.

-

Reduces the Risks

If you lack credible bank statements, it poses risks to entities in terms of disparities that might arise between their financial statements and actual cash flow.

Types of Statements Used For Corporate Reporting

-

Cash Flow Statements

Cash flow statements are highly reliant on bank statements. Bank statements list the timing of cash inflows and outflows. This enables finance managers to properly split their cash flow into operating activities, investing activities, and financing activities. This prevents the generation of misleading reports.

-

Income Statements

Although the income statement follows accrual accounting, the bank statements serve as a reality check for actual cash flow transactions. The bank statement verifies whether the funds received and paid out are reflected correctly in the reported figures of income.

-

Balance Sheets

Bank balances are an essential part of the asset side of the balance sheet. Bank statements are used as evidence that cash reporting is actually reflected in bank balances at a certain date.

-

Internal Management Reports

The company relies on internal reports to make its strategic decisions. Bank statements are used to provide the company with real transactions that help in financial planning.

Role of Business Bank Statements in Financial Reporting

-

Bank Statements For Financial Reconciliation

Reconciliation is a comparison of banking and accounting records to look for differences. It is essential to undertake a reconciliation regularly to:

- Missing transactions

- Duplicate entries

- Illegal or suspicious activity

Reconciliation helps a company maintain accurate records, as it reduces errors and increases internal controls. Bank statements play a critical role when it comes to reconciliation, as they provide a record that is objective and acts as tangible evidence of a company’s transactions.

-

Supporting Audits and Compliance

Auditors make extensive use of bank statements during the audit. This is the primary evidence utilized in the verification of cash transactions, enabling the person conducting the audit to check balances, trace transactions, and determine if any transactions are properly recorded in the accounts. From the point of view of ensuring regulatory compliance, the following are the important aspects:

- Tax filing obligations

- Financial reporting rules

- Anti-fraud and anti-money laundering regulations

Ready access to structured bank statements makes auditing straightforward and helps businesses maintain regulatory compliance.

-

Improving Transparency

Transparency in financial reporting is a primary need when you buy funds or pitch. Investors, lenders, and the board members can analyze the bank statement or a synthesized report extracted from it to:

- Liquidity levels

- Efficiency in cash flow

- Financial stability

Bank statements that are clear and transparent help in creating awareness regarding the handling of money in an organization, leading to increased trust in business governance.

-

Financial Planning Strategies

Apart from news reporting, another significant use of statements in banks relates to financial planning. Through examining previous financial transactions, businesses are in a position to:

- Determine Repetitive Costs

- Monitor revenue streams

- Project cash requirements into the future

- Optimize processes, spot inefficiencies, and identify

The constant analysis of bank statements helps organizations make strategic decisions based on data, preparing the way for businesses to grow by managing their working capital effectively.

Challenges in Managing Business Bank Statements

Although bank statements are a valuable source of information, handling them might be a problem, particularly in cases where the company has:

- Multiple bank accounts

- High transaction volumes

- Unorganized or irregular statement structures

Manual processing of the statements may cause reconciliations, delays, or difficulties in incorporating the data into the accounting system. Overcoming such difficulties is important in ensuring proper reporting within the firm.

Use an Online Bank Statement Maker for Managing Business Statements

The digital world has brought drastic changes in how businesses handle and make use of bank statements by using an online bank statement maker. The advantages are:

- Automated statement downloads

- Facilitates a realistic format for easier compilation

- Quick Reconciliation

- Increased security & access control

They minimize manual effort, increase data accuracy, and optimize the corporate reporting flow in organizations, making them essential for businesses in the present day.

Read our Blog on “Why Use Bank Transaction Generators for Financial Analysis?

Best Practices When Using Business Bank Statements

-

Conduct Monthly Reconciliations

Account reconciliation between accounting statements and bank statements to identify discrepancies or outstanding transactions.

-

Maintain Accessible Digital Records

Store bank statements in a secure and easily retrievable manner for audit and compliance requirements.

-

Cross-Check With Financial Statements

Analyze bank statements, income statements, balance sheets, or cash flow statements in comparison with each other in order to look for discrepancies.

-

Facilitate Secure Handling of Sensitive Data

If you want to ensure the confidentiality of sensitive financial information, you should use secure storage of bank statement generators, access mechanisms, and encryption.

These best practices will help ensure that the business statements provided to banks serve as an accurate basis for the company’s financial reporting.

Conclusion

Business bank statements are a cornerstone of accurate corporate reporting. They provide verified, consistent, and secure financial data that supports audits, compliance, and decision-making. Bank statements allow organizations to demonstrate the transparency and control they have over their finances. Business statements offer a practical, reliable, and scalable solution for companies focused on robust financial governance, which underpins every aspect of corporate reporting. Using online services and adopting best practices makes it even more valuable to make financial reporting efficient and effective.

FAQs

Why are business bank statements important for corporate reporting?

It helps provide clear documentation of cash flow transactions that enables the preparation of credible financial reports.

How do bank statements facilitate financial audits?

They are employed by auditors in confirming account balances, tracking transactions, as well as verifying the validity of the information contained in the financial statements.

Can corporate reports be accurate without bank statements?

No. The bank statements serve as independent verification that what is reflected in financial reports actually occurs in cash flows.

What is the optimal interval for reviewing bank statements?

It is recommended to review and reconcile accounts monthly to ensure accurate reporting and to promptly detect any errors.